Crypto liquidations within the past 24 hours have reached $825 million, with long positions dominating. The market crash comes as major altcoins begin to drop in value.

Crypto liquidations within the past 24 hours have reached $825 million, with long positions dominating. The market crash comes as major altcoins begin to drop in value.

Summary

- The crypto market saw a massive $825.4 million in total liquidations on Oct. 30, with long positions making up over 79% of the total. Bitcoin led the losses with $310.3 million in long liquidations.

- The market cap dropped 1.6% to $3.8 trillion as Bitcoin, Ethereum, and major altcoins like Solana and XRP saw sharp declines.

- The downturn was fueled by post-Fed rate cut uncertainty, excessive leverage, and fading investor momentum despite new ETF launches.

The crypto market saw a massive $825.4 million in total liquidations on Oct. 30, with long positions making up over 79% of the total. Bitcoin led the losses with $310.3 million in long liquidations.

The market cap dropped 1.6% to $3.8 trillion as Bitcoin, Ethereum, and major altcoins like Solana and XRP saw sharp declines.

The downturn was fueled by post-Fed rate cut uncertainty, excessive leverage, and fading investor momentum despite new ETF launches.

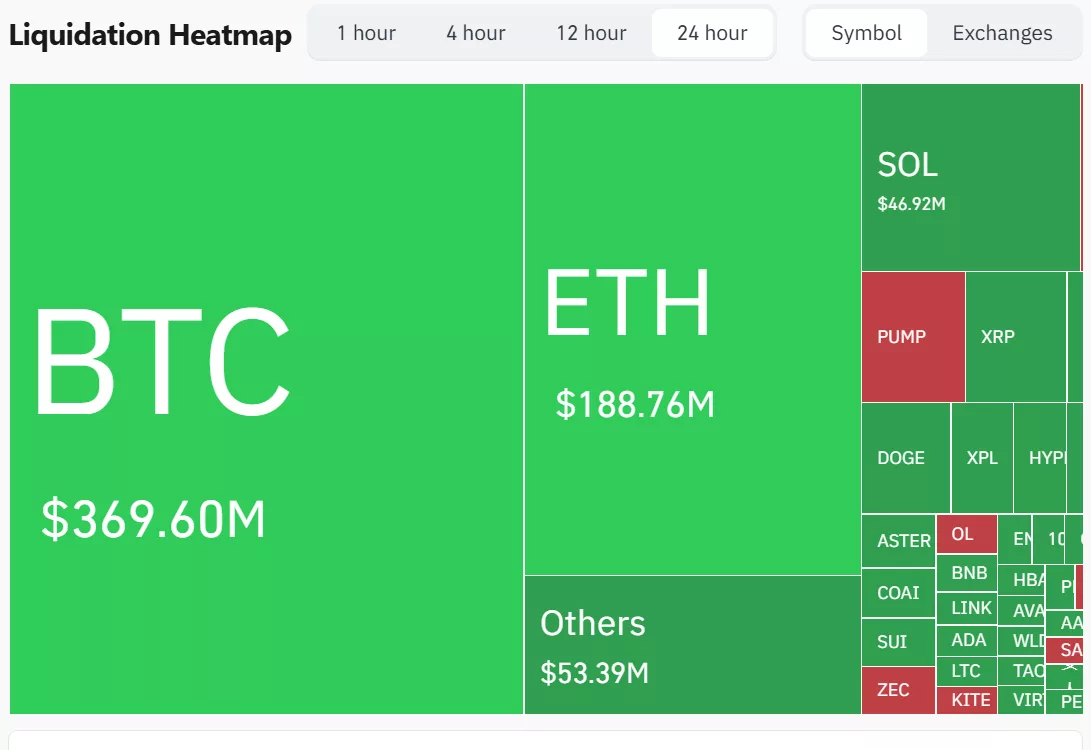

On Oct. 30, total liquidations across the crypto market have reached $825.4 million, growing closer to a massive $1 billion wipeout. Long positions contributed to the majority of liquidations, making up $656.7 million. Meanwhile, short positions have amounted to $168.9 million.

On Oct. 30, total liquidations across the crypto market have reached $825.4 million, growing closer to a massive $1 billion wipeout. Long positions contributed to the majority of liquidations, making up $656.7 million. Meanwhile, short positions have amounted to $168.9 million.

Among the positions, Bitcoin (BTC) long positions have seen the most liquidations compared to any other asset. Bitcoin long positions have reached $310.3 million, far overpowering Bitcoin short positions which stand at only $59.2 million.

Among the positions, Bitcoin (BTC) long positions have seen the most liquidations compared to any other asset. Bitcoin long positions have reached $310.3 million, far overpowering Bitcoin short positions which stand at only $59.2 million.

In the past hour, the industry has lost nearly $10 million in liquidations. Bitcoin liquidations dominate the heatmap, reaching $2.88 million, while Ethereum (ETH) has seen $2.41 million in liquidations. Other altcoins have reached $815,650, meanwhile Solana (SOL) holds up with $481,430 in liquidations.

In the past hour, the industry has lost nearly $10 million in liquidations. Bitcoin liquidations dominate the heatmap, reaching $2.88 million, while Ethereum (ETH) has seen $2.41 million in liquidations. Other altcoins have reached $815,650, meanwhile Solana (SOL) holds up with $481,430 in liquidations.

You might also like: Why is crypto crashing today after the Fed rate cut? Oct. 29

You might also like: Why is crypto crashing today after the Fed rate cut? Oct. 29

The mass liquidations have put a dent in the overall crypto market cap, which has dropped by 1.6% as it slips even farther below the $4 trillion mark. On Oct. 30, the overall crypto market cap has fallen to $3.8 trillion. Meanwhile, its 24 hour trading volume stands at $192 billion.

The mass liquidations have put a dent in the overall crypto market cap, which has dropped by 1.6% as it slips even farther below the $4 trillion mark. On Oct. 30, the overall crypto market cap has fallen to $3.8 trillion. Meanwhile, its 24 hour trading volume stands at $192 billion.

The wipeout was triggered by a chain of major tokens turning red over the past few hours. Bitcoin is currently trading at the edge of $110,000, as it drops 2.4% within the past 24 hours. Meanwhile, Ethereum has already fallen off its $4,000 high, having dipped by 2.5% to $3,899.

The wipeout was triggered by a chain of major tokens turning red over the past few hours. Bitcoin is currently trading at the edge of $110,000, as it drops 2.4% within the past 24 hours. Meanwhile, Ethereum has already fallen off its $4,000 high, having dipped by 2.5% to $3,899.

Despite two Solana ETFs recently launching on the market, Solana has fallen deeper below $200 after briefly reaching $201. At press time, the token has dipped slightly by 0.9% as it inches nearer to the $190 mark. Similarly, XRP (XRP) has lost about 3.5% and is currently trading hands at $2.56.

Despite two Solana ETFs recently launching on the market, Solana has fallen deeper below $200 after briefly reaching $201. At press time, the token has dipped slightly by 0.9% as it inches nearer to the $190 mark. Similarly, XRP (XRP) has lost about 3.5% and is currently trading hands at $2.56.

Smaller altcoins like Pi Network (PI) and Aster (ASTER) have also taken the brunt of the crash, slipping by 2.1% and 5% respectively. Dogecoin (DOGE) has fallen by 2.1% to just around $0.189 within the past day.

Smaller altcoins like Pi Network (PI) and Aster (ASTER) have also taken the brunt of the crash, slipping by 2.1% and 5% respectively. Dogecoin (DOGE) has fallen by 2.1% to just around $0.189 within the past day.

Why is the crypto market crashing right now?

Why is the crypto market crashing right now?

The recent crypto market crash is mostly driven by a combination of macroeconomic pressures, structural vulnerabilities and leveraged trading dynamics. Heightened uncertainty around monetary policy has made non-yielding assets like crypto even less attractive to investors.

The recent crypto market crash is mostly driven by a combination of macroeconomic pressures, structural vulnerabilities and leveraged trading dynamics. Heightened uncertainty around monetary policy has made non-yielding assets like crypto even less attractive to investors.

Following the Fed’s decision to slash interest rates by 0.25%, which was in line with analyst expectations, investors were quick to jump on the strategy of “buy the rumor and sell the news,” which usually sees prices going higher in anticipation of a certain event before mellowing out once the news has passed. This means that market momentum surrounding the Fed rate cut has died down.

Following the Fed’s decision to slash interest rates by 0.25%, which was in line with analyst expectations, investors were quick to jump on the strategy of “buy the rumor and sell the news,” which usually sees prices going higher in anticipation of a certain event before mellowing out once the news has passed. This means that market momentum surrounding the Fed rate cut has died down.

Moreover, the crypto market is laden with excessive leverage and thin liquidity. A large portion of trading volume comes from derivatives which enable huge exposure with little capital. When prices trickle down, liquidation cascades were triggered leading to forced closures of leveraged long positions pushed prices further down, which triggered more forced liquidations.

Moreover, the crypto market is laden with excessive leverage and thin liquidity. A large portion of trading volume comes from derivatives which enable huge exposure with little capital. When prices trickle down, liquidation cascades were triggered leading to forced closures of leveraged long positions pushed prices further down, which triggered more forced liquidations.

Despite the release of new crypto ETFs, such as the Bitwise Solana Staking ETF, Grayscale’s Solana Staking ETF and Canary’s Litecoin ETF and HBAR ETF, the momentum surrounding the launch appears to have waned as these tokens have dipped instead of going higher.

Despite the release of new crypto ETFs, such as the Bitwise Solana Staking ETF, Grayscale’s Solana Staking ETF and Canary’s Litecoin ETF and HBAR ETF, the momentum surrounding the launch appears to have waned as these tokens have dipped instead of going higher.

You might also like: Solana ETFs live now: Where’s the $200 Solana price breakout?

You might also like: Solana ETFs live now: Where’s the $200 Solana price breakout?

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter