Key Highlights

- Bitwise accelerates efforts to launch the first Spot Dogecoin ETF in the U.S., signaling growing institutional interest in the popular memecoin.

- Dogecoin shows early signs of recovery, with analysts predicting potential gains if it breaks key resistance levels around $0.17.

- Rising regulatory openness and crypto-friendly appointments, such as Paul Atkins to the SEC Chair, have paved the way for smoother ETF approvals.

Bitwise is pushing to list a Spot Dogecoin ETF in the United States. The firm filed an 8(a) form, which is an automatic effectiveness application that begins a 20-day countdown toward approval if the U.S. Securities and Exchange Commission (SEC) does not intervene.

The filing follows Bitwise’s earlier S-1 registration and the establishment of a Delaware entity intended to support the fund. This signals a major step in bringing a Dogecoin-backed investment product into regulated U.S. markets.

Earlier in September, Grayscale also submitted revised paperwork for its Dogecoin ETF proposal. This move sets up a similar countdown window. Consequently, multiple asset managers are now competing to introduce the first Spot Dogecoin ETF. This competition reflects increasing institutional awareness of Dogecoin’s liquidity and market presence.

The filing also aligns with the statements made by Bitwise Chief Investment Officer Matt Hougan in January this year. He told the Financial Times that Dogecoin already ranks among the largest crypto assets with strong daily trading volume. He emphasized high investor interest that continues to grow with broader adoption discussions.

Expanding institutional crypto access

The growing interest in Dogecoin ETFs fits a broader wave of crypto ETFs gaining mainstream financial traction. Besides Bitwise and Grayscale, Osprey Funds and Rex Shares have also prepared their own proposals.

Ongoing discussions about changing regulations are also shaping how investors view the market. The U.S. government has started developing new rules to better oversee digital assets. At the same time, the appointment of regulators who are seen as more open to crypto — such as Paul Atkins as SEC Chair — is helpful in creating a friendlier environment for ETF approvals.

Hougan also argued that companies holding digital assets on their balance sheets need more advanced strategies. He said, “If DATs limit themselves to that strategy, users are better off investing through exchange-traded funds.” He also noted that ETFs now include staking capabilities. Bitwise recently launched a product that locks coins to earn rewards. Hence, institutions may benefit more by leveraging ETF-based tools rather than building internal custody and staking systems.

Dogecoin market outlook shows recovery effort

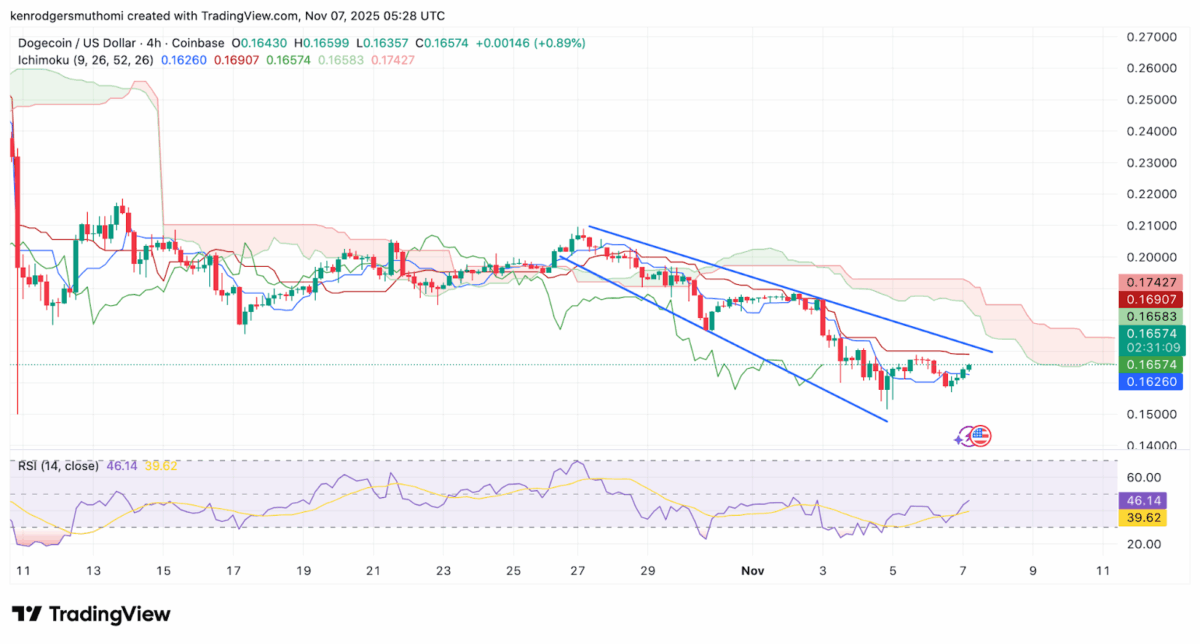

Dogecoin’s short-term price action is showing early signs of recovery. The 4-hour chart shows a downward channel but price bounced near the lower boundary. The bounce suggests that buyers are trying to turn the tide. Dogecoin, however, still trades below the Ichimoku Cloud—an indicator used to gauge a market’s trend and momentum. Prices above the cloud suggest an uptrend, below the cloud indicate a downtrend, and trading within the cloud signals uncertainty.

The cloud is currently resting near $0.169 to $0.174, which sets up a key resistance zone. A move above that level could flip market sentiment toward bullish control.

At the moment, Dogecoin trades at around $0.165. The Relative Strength Index (RSI) sits near 46, which suggests that the market isn’t showing strong buying or selling pressure at the moment. The RSI is an indicator that shows traders whether a cryptocurrency has been overbought or oversold in a short period of time.

If the price manages to stay above $0.162, it could help support a possible recovery. On the other hand, breaking past $0.17 might give buyers more confidence and push prices higher.

An analyst on X, Javon Marks shared a more optimistic long-term view. “The TARGET for this setup REMAINS $0.6533,” he said, pointing to a potential +300% move. His chart suggests Dogecoin completed a long downtrend and now builds higher lows. Marks also outlined a secondary target near $1.23 if momentum accelerates.

The progress toward a Dogecoin ETF could make it easier for everyday and institutional investors to buy the cryptocurrency, potentially boosting its trading activity and affecting its future price.

Also Read: Cathie Wood Cuts BTC Target to $1.2M by 2030 as Stablecoins Grow

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter