Dogecoin (DOGE) is attracting attention as traders anticipate a potential price surge.

After a period of consolidation, DOGE has traded above key moving averages and broken through a significant resistance trendline. Reduced leverage, as indicated by liquidation data, suggests the potential for increased volatility. Historical patterns following similar setups indicate the possibility of a strong rally, with many anticipating a price push towards $0.65 and beyond.

Technical Indicators Suggest Bullish Momentum

Dogecoin's price displays strong bullish patterns across various timeframes, trading above the 5-day, 10-day, and 20-day moving averages. This signifies robust short-term buying pressure and, if sustained, could support further price increases. Resistance remains near $0.185, while support at $0.175 appears firm, favoring bullish sentiment. The Relative Strength Index (RSI) shows overbought conditions, and the Moving Average Convergence Divergence (MACD) remains bullish, indicating strong momentum.

Source: X

While high RSI levels could trigger a short-term pullback, sustained price action above the moving averages suggests further upward potential. While short-term fluctuations are expected, focus remains on key levels indicating future price direction.

Dogecoin Price Breakout and Momentum

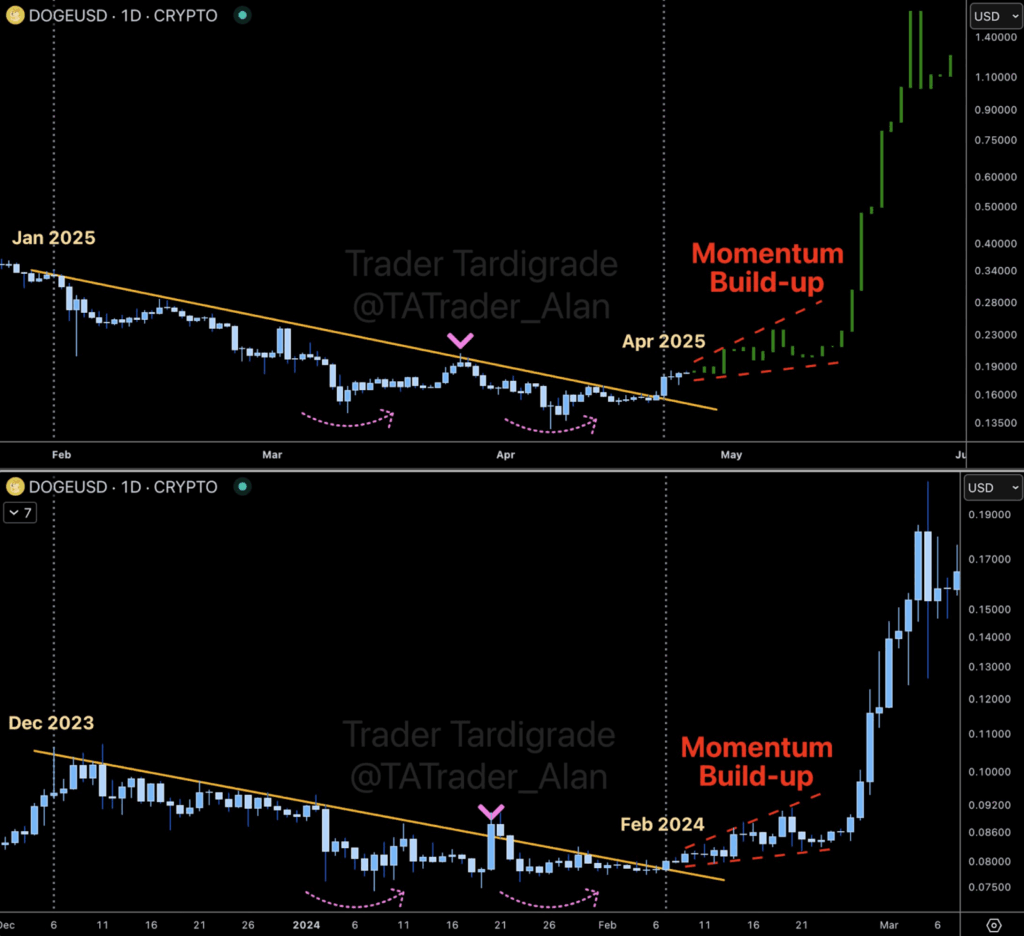

Analysis from Trader Tardigrade highlights Dogecoin's recent breakout from a multi-month resistance trendline. This resembles a similar breakout in February, which preceded a sharp price increase. Tardigrade notes the absence of signs of a false breakout, describing the technical setup as "explosive," and confirming a falling wedge breakout and double bottom accumulation pattern. These patterns often precede significant upward movements in cryptocurrencies.

Source: X

Historically, Dogecoin's momentum builds lead to substantial price changes in short periods. Target prices above $0.28, and even near all-time highs, are being discussed. At the time of writing, speculation centers on whether the breakout could propel DOGE past $0.65 and towards $1.00.

Short-Term Selling Pressure

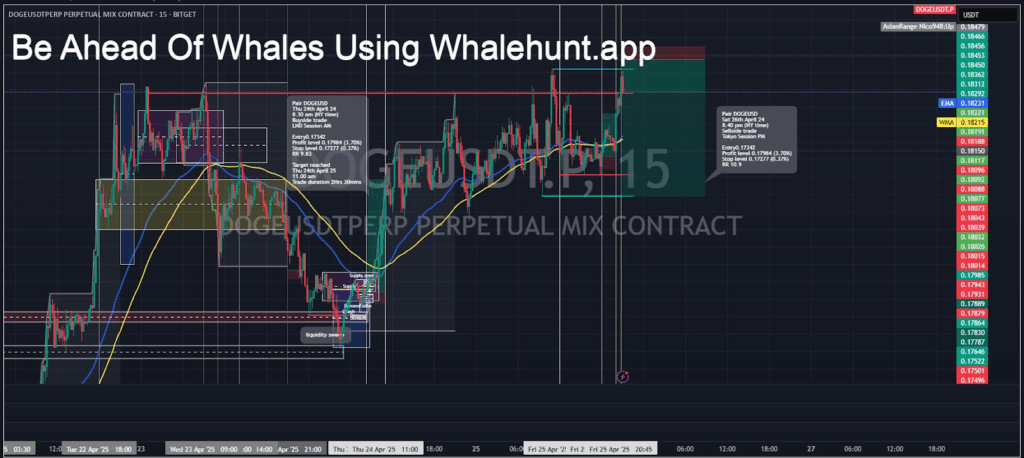

While the overall trend is positive, some traders are exploiting short-term selling opportunities. Andrew Griffiths identified a potential short trade based on exhaustion near intraday highs, establishing a short position at $0.17342 with a target of $0.16700 and a strict stop loss. DOGE's activation of a former supply region led to liquidation above recent resistance, followed by a strong reversal. These opportunities arise when rapid buying ends, allowing short sellers to capitalize on minor downward movements.

Source: X

However, these short-term setups don't alter the broader bullish outlook unless major support levels are breached. Despite a bearish short-term perspective, Griffiths acknowledges DOGE's sustained strength as long as key support holds. The current market exhibits a pattern where short-term trades occur alongside longer-term trends.

Liquidation Data Reinforces Bullish Sentiment

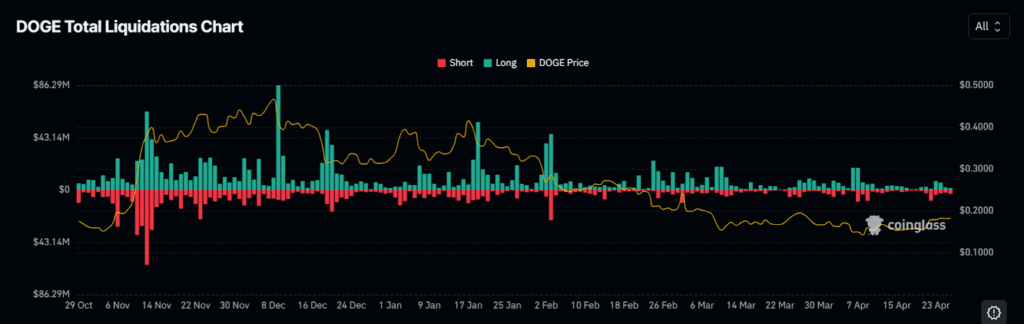

Recent liquidation data strengthens the case for a significant DOGE move. Analysts note a significant drop in market leverage after a prolonged period of heavy liquidations, suggesting that overleveraged traders have largely exited the market, paving the way for less volatile, more organic price movements.

According to CoinGlass data, recent increases in both long and short liquidations may signal a return to volatility. CoinGlass indicates that heavy liquidation phases often reset market conditions, and initial liquidation increases frequently precede major price movements.

Source: CoinGlass

CoinGlass' historical data shows that after periods of low leverage and quiet trading, Dogecoin often experiences sharp rallies. These signals, combined with broader technical indicators, suggest the potential for substantial future price movements.

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter