DOGE is nearing the apex of a symmetrical triangle pattern, currently testing a critical support level at $0.17574, which raises concerns about potential downside risks. While derivatives data reveals a decline in overall trading volume, options activity has surged by 114%, reflecting increased market uncertainty. Recent liquidations have disproportionately impacted long traders, who have suffered losses of $1.56 million, highlighting the pressures from short-term volatility on bullish positions.

Dogecoin ($DOGE) is at a pivotal point as its price tests a key support level within a long-established symmetrical triangle formation. With a current price of $0.17574, DOGE has experienced a 2.63% decrease today and is now positioned near the lower boundary of the pattern. Technical indicators and derivatives market dynamics suggest a potential breakdown if bullish momentum does not recover.

The DOGE/USD daily chart illustrates a symmetrical triangle that has been forming since February 2025, characterized by converging trendlines from lower highs and higher lows. This pattern typically signifies a period of consolidating price action and decreasing volatility, often preceding a significant breakout. As the price compresses towards the triangle's apex, a decisive move appears to be on the horizon.

Fibonacci retracement levels, drawn from the $0.49444 swing high to the $0.12864 low, provide additional context. DOGE has struggled to maintain upward momentum above key resistance levels. The 0.382 retracement level around $0.218 has acted as a barrier to recent upside attempts, while the 0.618 level at $0.275 capped the rally in April.

Since the decline, the 0.5 retracement zone near $0.310 has remained untested. Currently, DOGE is testing the lower support line of the triangle. Should the price break below this support, potential downside targets include $0.152 and $0.128, which align with previous Fibonacci extension zones. To re-establish a bullish outlook, DOGE would need to close above $0.218 and generate sufficient momentum to challenge the $0.275 resistance.

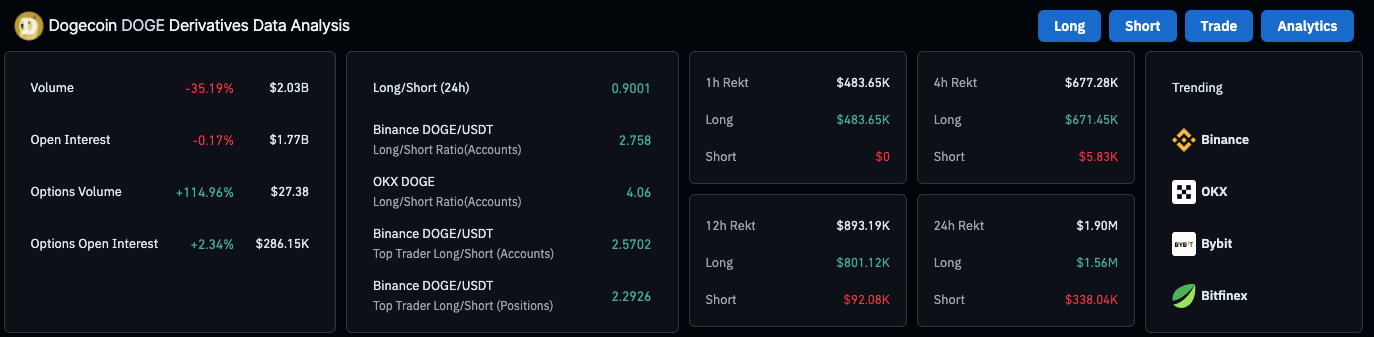

Trading Volume Declines as Options Activity Increases

Derivatives market data presents mixed signals. Overall, DOGE trading volume has decreased significantly by 35.19% in the last 24 hours, now totaling $2.03 billion. Open interest has slightly decreased by 0.17% to $1.77 billion, indicating reduced speculative interest in perpetual contracts.

Conversely, DOGE options activity has seen a substantial increase. Options volume has surged by 114.96% to $27.38 million, while open interest in options has risen by 2.34% to $286.15K. This increase suggests that traders are utilizing options for hedging strategies or directional bets amidst the prevailing uncertainty in spot and futures markets.

Despite the overall neutral market sentiment, specific platforms reflect bullish tendencies. The long/short ratio over 24 hours is 0.9001, indicating a slight preference for short positions. However, Binance’s DOGE/USDT account ratio stands at 2.758, and OKX reports a higher figure of 4.06. Among top traders on Binance, both the long/short account and position ratios exceed 2.29, suggesting optimism among more experienced participants.

Long Positions Experience Significant Liquidations

Liquidation data clearly demonstrates the vulnerability of long positions. In the past 24 hours, total DOGE liquidations amounted to $1.9 million, with $1.56 million affecting long positions. Short traders experienced losses of only $338.04K. In the most recent one-hour period, $483.65K in liquidations were recorded, exclusively from long positions, indicating that sudden price drops triggered margin calls on bullish trades.

This combination of potential technical breakdown and pressure on long positions highlights the current fragility of DOGE’s market structure. As the triangle's apex rapidly approaches, traders are awaiting a confirmed move that could dictate the next major trend.

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter