The sudden market crash on Friday, which caused some cryptocurrencies to decline by as much as 95% in under 24 hours, does not signal a long-term bearish outlook or deteriorating fundamentals, according to investment analysts at The Kobeissi Letter.

Friday’s market meltdown was triggered by a perfect storm of short-term factors, including “excessive leverage and risk,” and US President Donald Trump’s announcement of 100% tariffs on China, the analysts wrote.

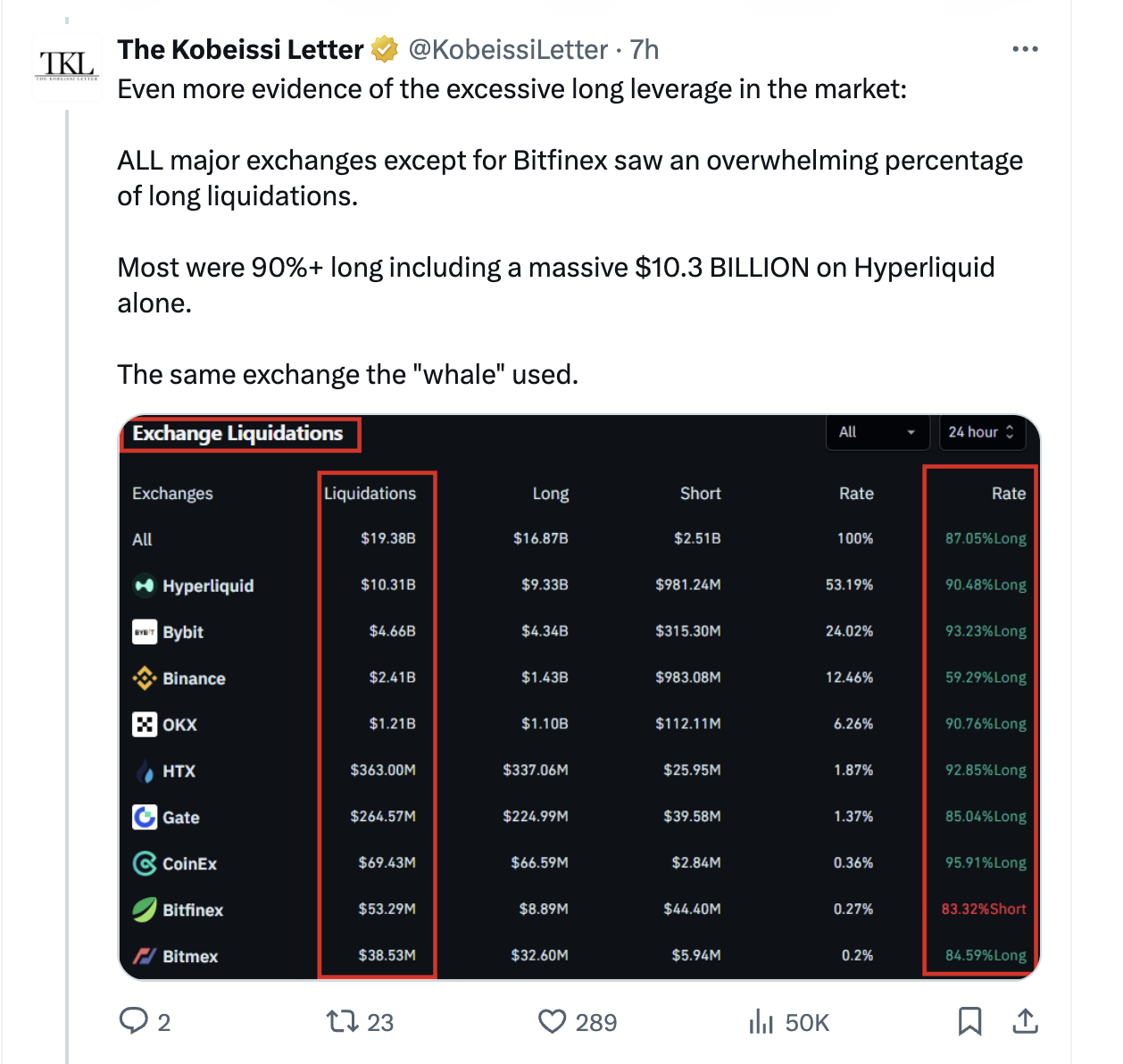

The Kobeissi letter cited the market’s heavy long bias, with $16.7 billion in long positions liquidated compared to just $2.5 billion in short positions, a ratio of nearly 7:1.

Moreover, the Trump announcement came around 5 PM on Friday, when market liquidity is thin, creating a fertile ground for heightened price volatility and large, outsized moves. The Kobeissi Letter added:

“We believe this crash was due to the combination of multiple sudden technical factors. It does not have long-term fundamental implications. A technical correction was overdue; we think a trade deal will be reached, and crypto remains strong. We are bullish.”

The crypto market crash on Friday triggered a $20 billion cascade of liquidations, shaking out nearly 1.6 million traders from their positions within 24 hours, eclipsing previous crises, including the collapses of the FTX exchange and the Terra/LUNA ecosystem.

Related: Crypto sentiment flips to ‘Fear’ as Bitcoin plunges after Trump’s tariffs

Analysts urge caution over the short term as leveraged traders are washed out of the markets

Bitcoin (BTC) investors and traders should expect price volatility in the short term as the markets digest the Trump tariff announcement and the macroeconomic implications, according to Cory Klippsten, CEO of Bitcoin services company Swan Bitcoin.

The market rout will “wash out leveraged traders and weak hands,” and consolidate to provide fuel for the next rally to new highs, Klippsten told Cointelegraph.

Other analysts and traders say that the $20 billion in crypto liquidations represents the tip of the iceberg, and that reported losses are only a fraction of the real financial damage to the markets and participants.

Magazine: Elon Musk Dogecoin pump incoming? SOL tipped to hit $300 in 2025: Trade Secrets

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter