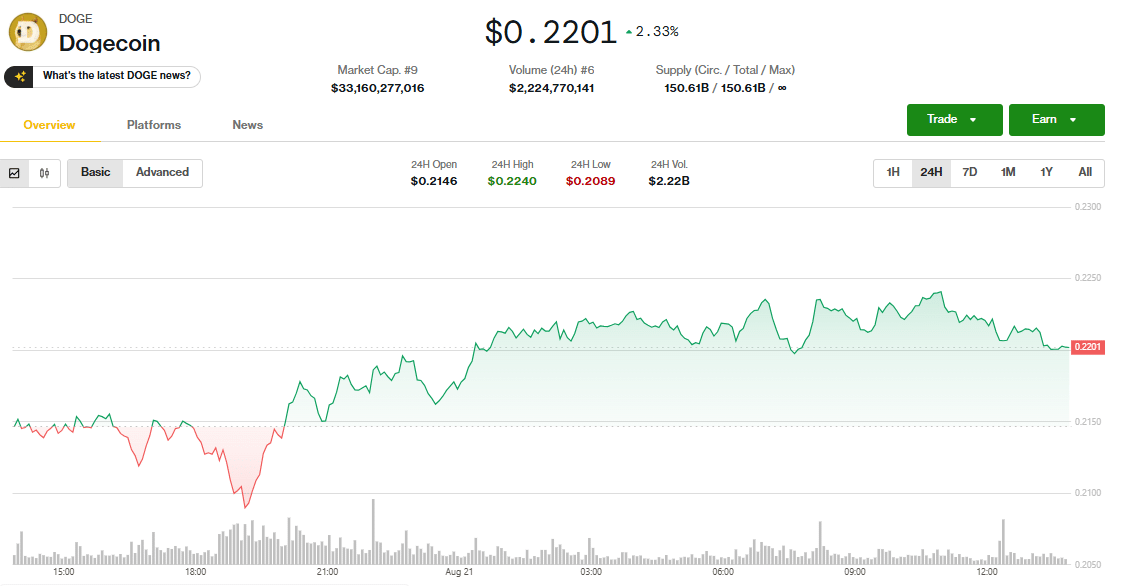

According to recent on‑chain data, Dogecoin whale accumulation has triggered a sharp V-shaped rebound from $0.21 lows, reminding the market that large holders still set the tone. On-chain data shows whales continue to load up during pullbacks, often sparking sudden rebounds that catch traders off guard.

The latest rally underscores a pattern seen repeatedly this year: when big wallets move, the broader market follows.

Why Whale Buying Matters Now

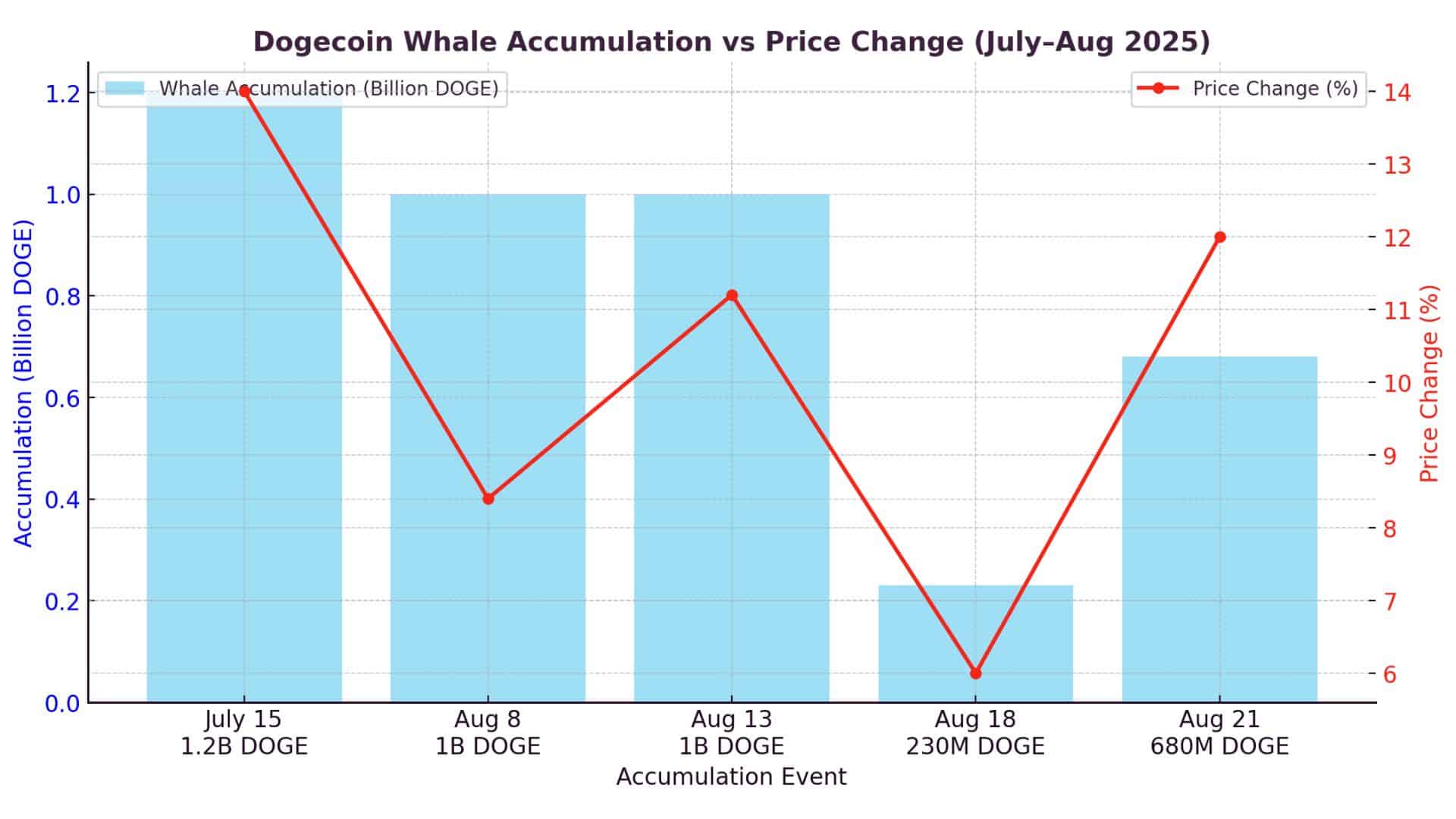

Whales added over 680 million DOGE in August, pushing their holdings to multi-month highs and significantly shrinking the float.

They also scooped up about $480 million worth of DOGE amid a dip, even as prices slipped ~3%, signaling intent rather than panic.

Earlier in the same month, whales bought over 1 billion DOGE in a single day, among the most significant accumulation events seen recently.

Price Moves Reflect Whale Patterns

Whale accumulation links closely with sharp price moves. DOGE jumped 8.4% in 24 hours, rising from $0.20 to $0.22 after whales added over 1 billion tokens. Another spike, an 11.2% gain, followed when 1 billion DOGE (about $200 million) entered whale wallets within a single day, lifting prices near $0.24.

These rebounds highlight the power of large holders. When whales scoop up such volumes, liquidity tightens and prices react quickly. Retail traders often spot the shift only after the breakout, which makes tracking whale activity an essential strategy.

Analysts note that while whales spark the rally, smaller traders often fuel momentum. This creates a feedback loop where whale activity drives optimism, and optimism drives further buying. The pattern has repeated throughout the year, showing a clear link between whale inflows and short-term DOGE surges.

Tracking Accumulation Against Resistance

Whales picked up 230 million DOGE in 24 hours as prices broke above $0.218, removing tokens from circulation and fueling momentum toward $0.28–$0.29. This buying pressure cut supply on exchanges, making it harder for bears to push prices lower.

Support remains near $0.21, while $0.25 acts as both a technical barrier and a psychological line for retail traders. A clear break above could open the way to $0.27–$0.30, but slipping below $0.21 risks renewed selling pressure.

On-chain charts also show growth in wallets holding 10M–100M DOGE, signaling that medium whales are joining larger players. Traders note that whale bids often sit just below support, cushioning the downside and signaling where strong hands plan to accumulate more.

Insight for Traders

Whales don’t just move markets; they reveal them. Dogecoin whale accumulation tells us when major investors see value and jump in.

For retail traders, the lesson is clear: keep an eye on wallet flows. Dogecoin whale accumulation is not a guarantee of profits, but it signals where the market’s weight is moving. If the pattern holds, the $0.21 level could act as a new support line, with potential resistance forming at $0.24. Market strategists advise caution, though. Whale accumulation can trigger quick rallies, but it can also mask long-term intentions.

As an analyst said, “Whales are not in the business of charity. They buy low and sell high, and retail traders often get caught in the middle.”

Charts show that buying often comes amid consolidation, then rallies follow. Watching on‑chain metrics helps traders anticipate these inflection points rather than react late.

What Comes Next?

Suppose accumulation holds steady, gains beyond $0.23 become realistic. Resistance levels between $0.22 and $0.24 remain important short‑term focal points.

Meanwhile, optimism around possible crypto ETFs may amplify momentum especially if whales stay active.

Conclusion

Based on the latest research, Dogecoin whale accumulation continues to shape the coin’s sharp rebounds and market sentiment. The V-shaped recovery from $0.21 shows how big wallets act as silent anchors in volatile waters. For traders, whale activity remains a reliable compass, signaling both opportunity and caution.

As long as whales hold sway, Dogecoin’s price action will likely mirror their moves, reminding the market that confidence often follows capital.

To get more detailed insights into the world of cryptocurrencies, check out our latest articles.

Summary

Dogecoin’s latest V-shaped recovery from $0.21 was powered by Dogecoin whale accumulation, highlighting the influence of large holders in steering price action. Analysts note that whales buying during dips often trigger rapid rebounds, shaping sentiment for retail traders. Data shows similar patterns in past rallies, making whale activity a key signal for future movements. For investors, tracking whale flows through on-chain analytics is essential, as their moves continue to define Dogecoin’s resilience in volatile markets.

FAQs on Dogecoin Whale Accumulation

Q: What is whale accumulation?

When large holders (whales) buy significant amounts of DOGE over a short period, it can lead to a substantial increase in the price of DOGE.

Q: Why does that matter for Dogecoin?

Because these holders can shift market supply and influence short‑term price moves.

Q: Where can traders track accumulation?

Use on‑chain analytics platforms like IntoTheBlock, Whale Alert, and Binance’s analytics tools.

Q: Does whale accumulation always lead to gains?

Not always, but repeated patterns show a strong link between these buys and upward moves.

Glossary of Key Terms

Whale: A crypto holder with enough assets to sway markets.

Support: Price level where buyers step in.

Resistance: A ceiling where selling pressure builds.

On‑chain analytics: Tools tracking blockchain activity like large wallet transfers.

Float: Coins available for trading.

Sources / References

Read More: Massive Whale Buys Push Dogecoin Into V-Shaped Rally">Massive Whale Buys Push Dogecoin Into V-Shaped Rally

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter