If you're following cryptocurrency market developments, you've likely seen Coinbase Derivatives introduce XRP futures contracts to its US derivatives exchange. This reflects a broader trend of regulated platforms expanding futures trading access, providing investors with new ways to engage with digital assets like XRP (XRP).

But what are XRP futures, and how can you participate? Let's explore.

What are XRP Futures?

XRP futures are standardized contracts allowing you to agree to buy or sell XRP at a predetermined price on a future date. Instead of trading the actual token, you trade a contract tracking XRP's price.

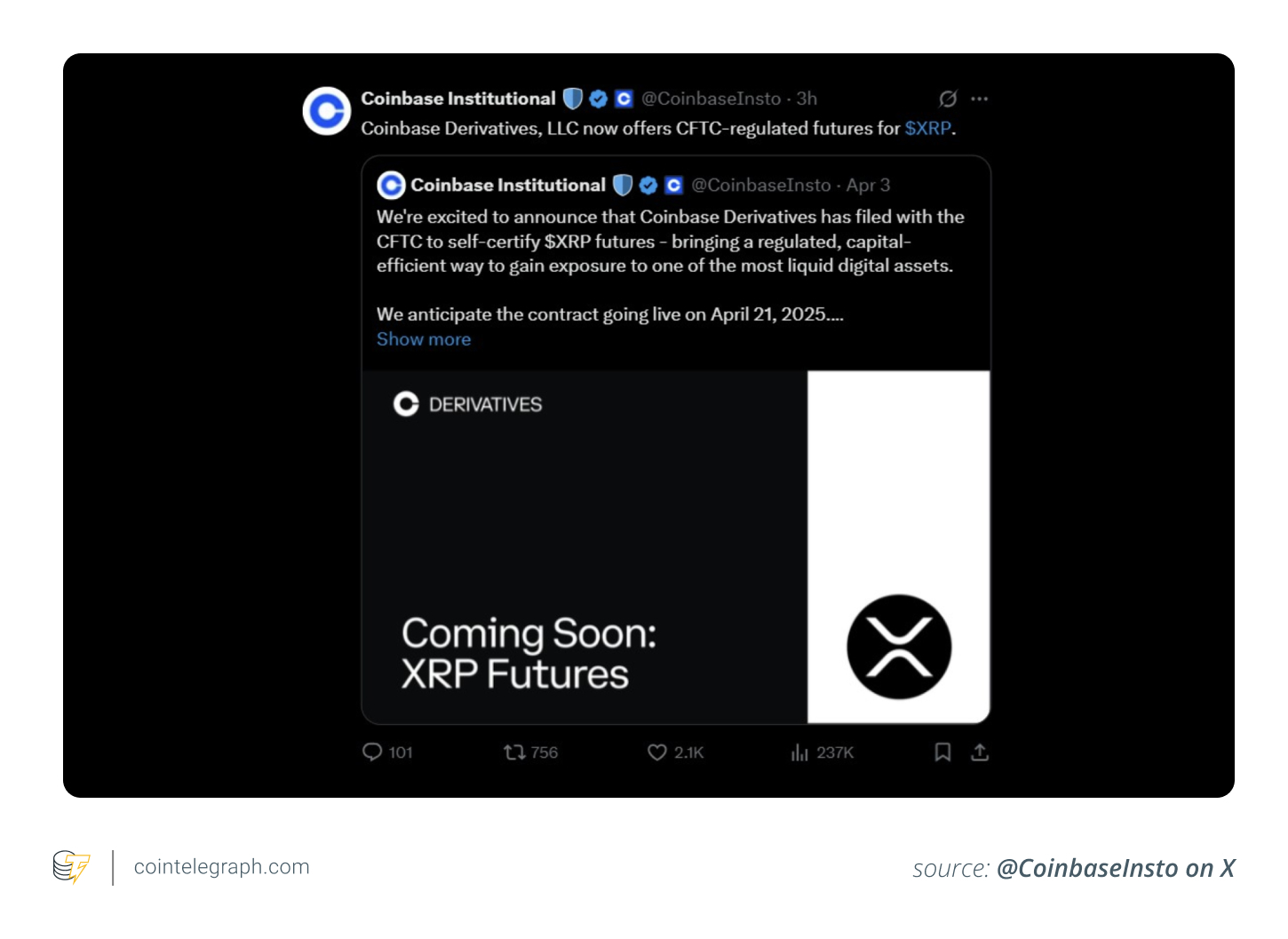

These contracts are overseen by the US Commodity Futures Trading Commission (CFTC), ensuring a regulated environment. This appeals to many investors seeking the oversight and structure lacking in unregulated platforms. Coinbase Derivatives filed with the CFTC for self-certification of XRP futures contracts on April 3, 2025, launching them on April 21, 2025.

Types of XRP Futures Contracts Offered by Coinbase

Coinbase offers:

- Nano XRP Futures: Represent 500 XRP per contract, cash-settled in USD. Ideal for retail traders and smaller institutions due to lower capital requirements.

- Standard XRP Futures: Cover 10,000 XRP per contract, also USD-settled, targeting larger institutions and active traders.

This variety allows you to choose a contract size aligning with your risk tolerance and investment strategy. "Cash-settled" means you don't receive XRP; profits or losses are calculated based on the price difference and settled in USD.

Why Choose XRP Futures Over Buying XRP?

Why choose futures over spot market purchases? Several reasons exist:

- Leverage: Control larger positions with less capital, amplifying gains but also losses.

- Hedging: Protect your portfolio from short-term XRP volatility if you already own it.

- Speculation: Take long (bullish) or short (bearish) positions, profiting from market movements in either direction.

- No Wallet/Storage Needs: Avoid the risks of managing private keys associated with XRP wallets.

- Liquidity and Accessibility: Futures markets often offer higher liquidity and potentially lower barriers to entry than some crypto platforms, especially in regions with regulatory restrictions.

- Cash Settlement: Simplifies trading by settling profits/losses in fiat currency, eliminating XRP custody.

When to Choose Futures Contracts:

- You want leveraged trading of XRP price movements with long or short flexibility.

- You prefer avoiding crypto wallets and custody.

- You're hedging an existing XRP position.

- You understand the complexities and risks of derivatives.

When to Buy XRP:

- You believe in XRP's long-term value and want to hold it as an investment.

- You intend to use XRP for transactions within its ecosystem.

- You want to avoid the risks of leverage and margin calls.

Ultimately, futures suit active traders seeking leveraged exposure, while buying XRP is better for long-term holders or users of the asset. Always assess your risk tolerance and goals before investing.

Where to Invest in XRP Futures

Several platforms (beyond Coinbase) offer XRP futures, depending on your location and needs:

- Kraken Futures: Offers leveraged XRP futures (with regional access restrictions).

- Binance: Offers XRP/USDT perpetual futures contracts (with limitations on XRP as a margin asset).

- OKX: Provides XRP/USDT perpetual swaps (expiry futures contracts delisted).

- Bitget: Offers XRP futures with long/short options (availability depends on regional regulations).

- KuCoin Futures: Supports XRP perpetual contracts (XRP/USDT) with leverage.

- MEXC: Offers XRP futures in USDt-margined and coin-margined formats.

- Delta Exchange: Lists XRP perpetual futures with high leverage.

- Bitfinex: Offers XRP futures as part of its derivatives portfolio.

How to Invest in XRP Futures

To trade XRP futures:

- Choose a Platform: Select a regulated exchange offering XRP futures (e.g., Coinbase's US Derivatives Exchange). Create an account and verify your identity.

- Understand the Product: Research contract sizes, margin requirements, leverage, and fees. Futures are complex; understand the risks.

- Fund Your Account: Deposit funds as collateral (margin) for trading. Check minimum deposit and margin requirements.

- Place Your Trade: Use the platform's interface to select XRP futures contracts (e.g., XRL on Coinbase) and specify your trade details.

- Practice Risk Management: Set stop-loss orders, limit position sizes, and avoid over-leveraging.

- Monitor the Market: Track XRP's price, market sentiment, and external factors to inform your strategy.

Oregon Targets Coinbase Over XRP, Cites Securities Violations

Oregon's Attorney General sued Coinbase, alleging the exchange offered unregistered securities, including XRP. The lawsuit argues various digital assets traded on the platform qualify as investment contracts under state law. This follows the SEC's dropped case against Ripple and Coinbase's listing of XRP futures.

How Risky Are Crypto Futures?

Futures trading involves significant risks:

- Leverage Risk: Amplifies both gains and losses.

- Volatility: XRP's price swings can impact your position significantly.

- Funding Rates: Perpetual futures contracts incur periodic fees.

- Liquidation: Positions can be automatically closed if your margin falls below the required level.

- Complexity: Futures are more complex than spot trading.

- Market Liquidity: Thin order books can cause slippage and price movements.

- Emotional Pressure: Impulsive decisions can occur in fast-paced trading.

If you're new to futures, start with a demo account or nano contracts to minimize exposure while learning.

This article does not provide investment advice. Every investment decision involves risk; conduct your own research.

Crypto Front News

Crypto Front News Coindoo

Coindoo CoinCryptoNews

CoinCryptoNews Coinlive.me

Coinlive.me Crypto Economy

Crypto Economy Coindoo.com

Coindoo.com Cointelegraph

Cointelegraph Crypto News Land

Crypto News Land BlockchainReporter

BlockchainReporter